19+ Kansas Property Tax Calculator

Updated for 2023 tax year on Jul 18 2023. Web The Kansas Property Tax Payment application allows taxpayers the opportunity to make property tax payments on their desktop or mobile device.

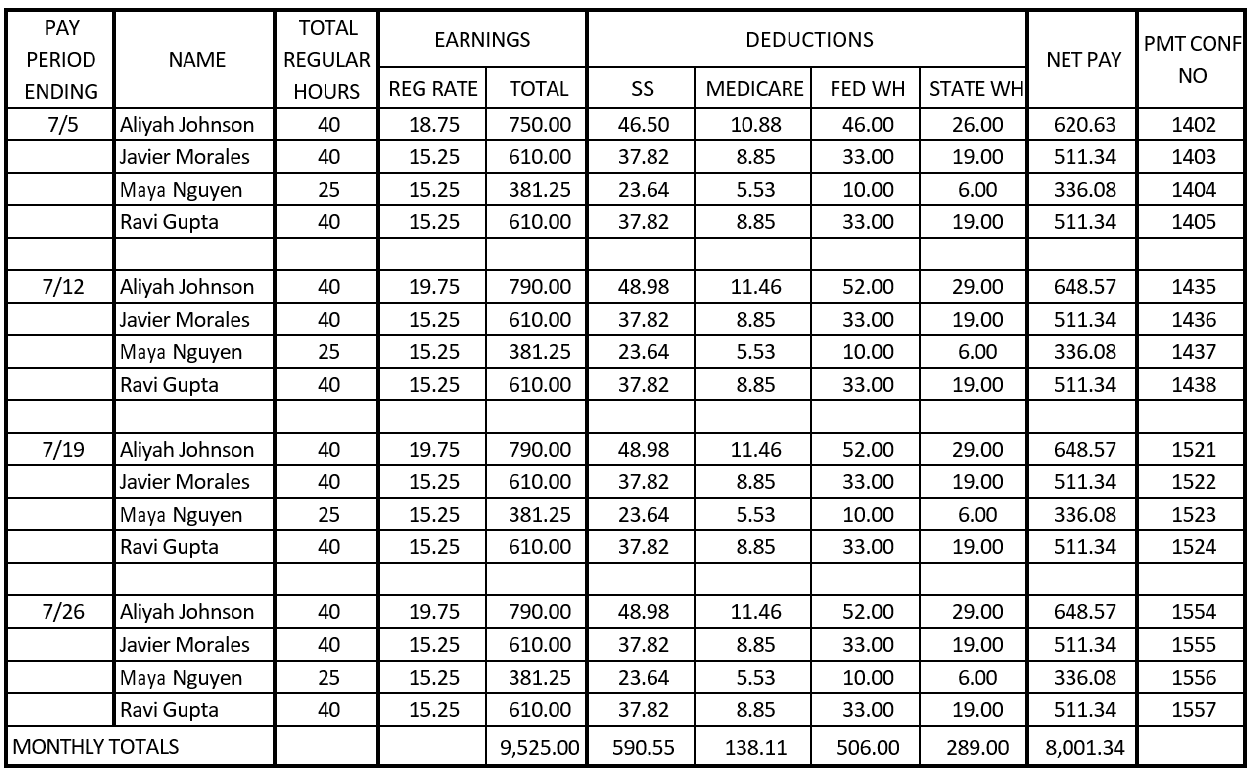

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Web Kansas Paycheck Calculator For Salary Hourly Payment 2023.

. Web The Kansas Department of Revenue offers this Tax Calculator as a public service to provide payers of Kansas income tax with information to estimate their overall annual. Maintaining guidelines for the valuation and taxation of personal property. Use our paycheck tax.

Compare your rate to the Kansas both US. Web 1 day agoThe federal government funneled cash to individuals and businesses with onset of the COVID-19 pandemic. Enter Any Address Now.

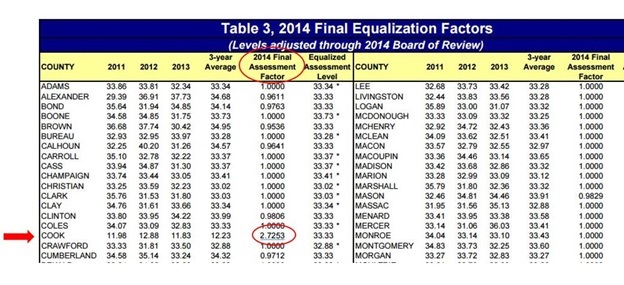

Web Our Sumner County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. Your property taxes are determined by multiplying the actual value times the assessment rate times the mill levy. The Clerk has accumulated the budget for each entity and the assessed valuation.

Web Kansas taxes are levied based on a mill rate which can be calculated as Budget divided by Value. Enter your info to see your take home pay. A public hearing will be held at 200 pm.

This online service is provided. Web You are able to use our Kansas State Tax Calculator to calculate your total tax costs in the tax year 202324. Our Kansas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden.

Web Property Tax Calculation. Interest rates on loans were low and savings rates were. Web There are only three tax rates for long-term capital gains ranging from 0 to 20 and the IRS notes that most taxpayers pay no more than 15.

Press Show Values to see the. Show the breakdown of property taxes. Web The Personal Property Sections responsibilities include.

Web Official Website of the Kansas Department of Revenue. Ad Its Faster than Ever to Find Property Taxes Info. Web Calculates how much youll payable in property taxes on your home given your location and assessed start value.

Web Kansas Income Tax Calculator Tax year 2023. Web Use our income tax calculator to find out what your take home pay will be in Kansas for the tax year. Web Estimate My Kansas Property Tax.

Estimate your Kansas income tax burden. Ad Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Enter MarketAppraised Value of Your Residential Property.

Updated for 2023 tax year on Sep 19 2023. Calculate your take-home pay after federal Kansas taxes. Counties may tax such property at a rate of up to 075 percent and cities or townships may impose an intangible.

Enter your details to estimate your salary after tax. The assessment rate on residential. Web SmartAssets Kansas paycheck calculator shows your hourly and salary income after federal state and local taxes.

Our calculator has recently been updated to include both the. Uncover In-Depth Assessment Information on Properties Nationwide. Web Cities counties and townships can levy taxes on intangible property.

Discover Helpful Information And Resources On Taxes From AARP. Wednesday November 29 2023 to consider a. Web Residential Property Tax Calculator.

Curious to know how much taxes and other deductions will reduce your paycheck. Maintaining values for KSA. Web Our Sedgwick County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

9 Best Property Management Companies In Bozeman Mt 2023

419 W 63rd Street Kansas City Mo 64113 Mls 2438756 Ksheart R

5215 N 139th St Kansas City Ks 66109 Mls 2421174 Zillow

Kansas Property Tax Calculator Smartasset

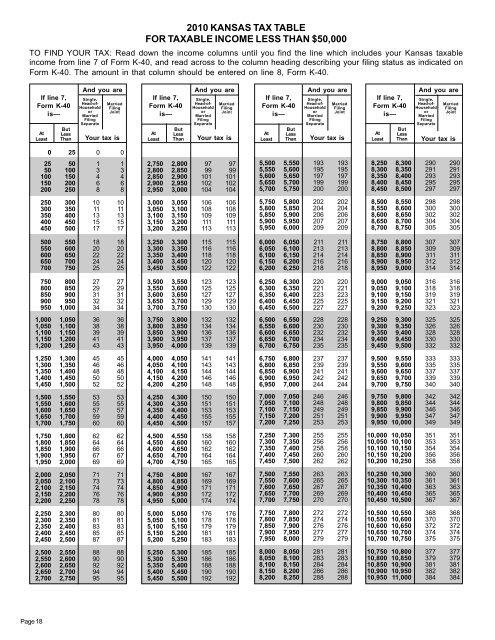

Individual Income Tax Tables And Rates Kansas Department Of

311th Coldwater Road Louisburg Ks 66053 Compass

Kansas Department Of Revenue Property Valuation Data By County

2023 Beverage Alcohol Tax Rules Changes Avalara Guide

311th Coldwater Road Louisburg Ks 66053 Compass

Calculate Your Community S Effective Property Tax Rate Civic Federation

Thrifty Nickel Kansas City By Thrifty Nickel Kansas City And Saint Joseph Issuu

Faq S On Personal Property Crawford County Ks

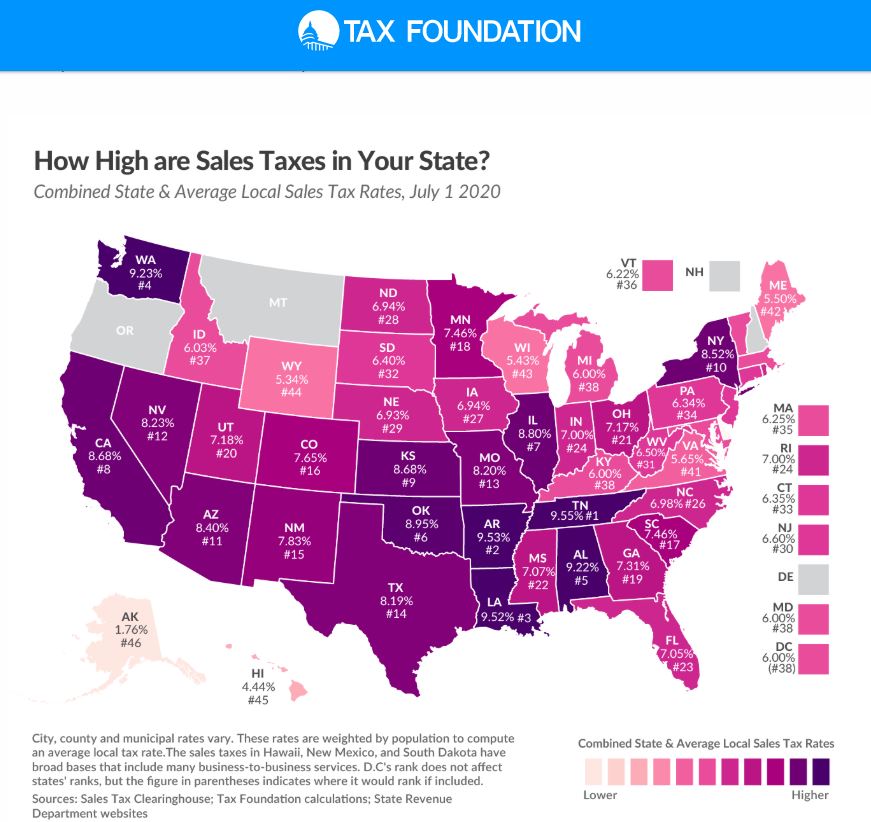

Kansas Has 9th Highest State And Local Sales Tax Rate The Sentinel

18785 W 199th St Spring Hill Ks 66083 Mls 2446413 Redfin

Property Tax Calculator City Of Pittsburg

Kansas State Taxes Ks Income Tax Calculator Community Tax

2023 Beverage Alcohol Tax Rules Changes Avalara Guide